All Categories

Featured

However, these plans can be much more intricate contrasted to other kinds of life insurance policy, and they aren't necessarily appropriate for every investor. Speaking with an experienced life insurance policy agent or broker can assist you make a decision if indexed global life insurance policy is a great suitable for you. Investopedia does not supply tax, investment, or financial services and suggestions.

, including a long-term life plan to their investment profile might make sense.

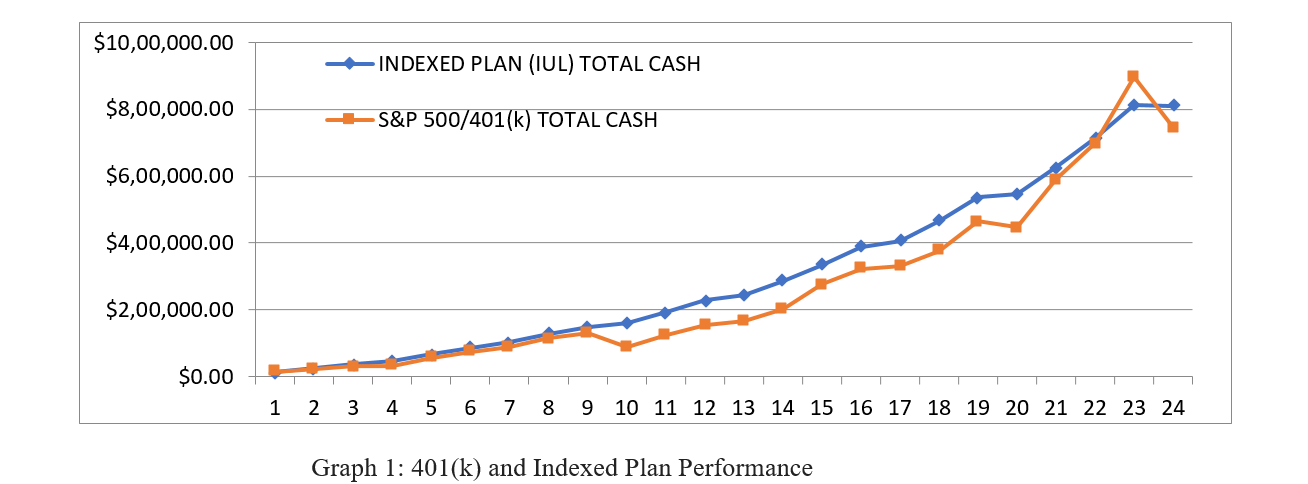

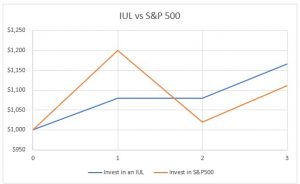

Reduced rates of return: Current research study located that over a nine-year duration, employee 401(k)s grew by approximately 15.6% each year. Contrast that to a fixed rate of interest rate of 2%-3% on a permanent life policy. These differences add up over time. Applied to $50,000 in financial savings, the costs over would certainly amount to $285 per year in a 401(k) vs.

In the same capillary, you could see financial investment development of $7,950 a year at 15.6% interest with a 401(k) compared to $1,500 each year at 3% interest, and you would certainly invest $855 even more on life insurance policy every month to have entire life protection. For the majority of people, obtaining irreversible life insurance policy as component of a retirement is not an excellent concept.

Indexed Universal Life policies is a top strategy for retirement planning. Planning your retirement is easier with the right IUL policy. With tax-deferred growth and potential tax-free withdrawals.

IUL policies are tied to stock market performance, ensuring potential returns without risking your principal. Insurance agents can design a policy tailored to your retirement goals. With premium flexibility and emergency access, IUL adapts to changing needs.

Whether you’re starting to save or preserving wealth, IUL offers a robust foundation (IUL for infinite banking brokers recommend). Speak with an Indexed Universal Life expert today to explore retirement planning with IUL

Penn Mutual Iul

Below are two typical kinds of long-term life policies that can be utilized as an LIRP. Entire life insurance policy deals dealt with premiums and money value that expands at a set rate established by the insurance provider. Standard investment accounts commonly offer greater returns and even more versatility than whole life insurance, but entire life can supply a fairly low-risk supplement to these retired life cost savings methods, as long as you're positive you can pay for the premiums for the life time of the policy or in this instance, till retired life.

Latest Posts

Iul Sales

Universal Life Insurance Calculator

Universal Life Target Premium